Download.file R With Password

It's tax time again, not that you needed reminding. It shows up at the same time every year, ready, willing, and able to escort you down a financial memory lane.

When it comes to filing income taxes, this year, more than any other, is likely to throw some curveballs. There were stimulus payments, and employment payments; you may have made more or less income than you did in the previous year. Sad to say, but bankruptcy, the death of a loved one, or the loss of job may factor into your financial situation more this year than at any other time in your personal history. Your tax software needs to be up to the task of getting every tax break possible.

We're going to look at the Big Three of online tax filing: TurboTax, H&R Block, and TaxAct. All three offer a standardized set of features that will get your taxes done quickly and easily, but they each offer unique benefits that could be more suitable for your particular set of filing needs for the 2020 tax filing season.

What's more, all three of these tax prep services offer options for you to "sit down" with a tax consultant without ever having to leave your house. This feature is new for TaxAct this tax season, but both H&R Block and TurboTax have offered this option for a couple of years now.

Note that all the prices listed for each of these products was the price at the time this article was written and every company charges more the closer you get to April 15. So don't wait!

TaxAct review

TaxAct is inexpensive, easy to use, and is the product I've used for both my business and personal taxes for the last several years. It is the only online tax filing program that allows you to file corporate taxes and it can also import information from your K1 directly into your personal income tax filing.

TaxAct's initial interview begins at the sales screen where you pick the package you need to file your taxes. TaxAct offers four tiers for personal taxes, from a free filing option, which costs nothing for qualified filers, to a self-employed option that costs $65. Additionally, TaxAct now offers a feature called TaxAct Xpert Help, which you can use to consult a tax professional for an extra $35 per return. No matter what, if you're in a state that requires you to file taxes, you'll need to spend an additional $20 to file your state return.

TaxAct

TaxAct TaxAct joins the competition in offering live assistance as an option of its online service.

The process

If you've used TaxAct in the past it will import your prior year's tax return into your new return and then ask you to confirm that your personal information is still correct. First-time TaxAct users need to go through the process of adding personal information before they can begin a return.

Next, the program will begin collecting your financial information, starting with your income. The TaxAct interview process is a series of question you answer by checking boxes. Do you have a W-2? Check. Rental Income? Check. Did you receive a 1099? If so, which types of 1099s did you receive? And so it goes until you've answered each of the questions appropriate for you.

Once you've completed this initial interview you will be offered "the chance" to share your personal details with TaxSmart Research,LLC, a sister company to TaxAct that wants to sell you other related features and options. I recommend you skip this, but feel free to read the details to see if it makes sense for you.

Conclusion

There's nothing too fancy about the TaxAct interface. It's just a one-foot-in-front-of-the-other process, but, while it lacks the comfy-cozy feel of TurboTax and H&R Block, it doesn't really need it. All of TaxAct's information is well-organized and easy to understand, so you'll step through the process with a complete sense of ease.

Rob Schultz / IDG

Rob Schultz / IDG H&R Block review

H&R Block sports a completely new look and feel. Taking a cue from Intuit's TurboTax, H&R Block now looks a little less corporate and a lot more cheery, which may just take the edge off paying your taxes. I really like the new redesign, not just because it looks good, but because it also seems easier to use than I recall previous versions being.

As noted earlier, H&R Block has long provided the option to work with a tax professional while filing your taxes. In this year's version of the online app, the first question you'll be asked is if you want to file your taxes on your own or if you want to use a tax professional. As always, because H&R Block has brick and mortar locations, you have the option of working with a professional virtually or you can choose to be with them in person at your local Block location. Note that, at any point in time, you can choose to use a tax professional, even if you started doing your taxes on your own.

H&R Block

H&R Block H&R Block's cheery new design.

The process

Once you've chosen your filing option the path forward is pretty basic: Enter your information in a step-by-step manner. H&R Block starts the process with a brief Q&A about COVID-19 and how that might affect your 2020 tax filing. H&R Block's answers to these questions are excellent, but bear in mind that, if your income was complicated by or nonexistent because of COVID-19, it's likely in your best interest to consult someone who knows every nook and cranny of the latest tax law, whether that's one of H&R Block's tax professionals or someone local to you who may also be familiar with your state tax laws.

H&R Block offers five separate options for filing your taxes, from a free version to a self-employed version that costs $85. Block's two least expensive options, Free and Plus, also offer free state tax filing. All the other tiers require you to pay to file state taxes. Also note that, if you were self-employed in 2020 and want to report business deductions or claim your small business' expenses, you'll be using the $85 package.

Like TaxAct, H&R Block wants you to sign a waiver allowing one of Block's related companies to look at your financial info so they can sell you stuff. Again, I recommend you skip that and get on with the business of filing your taxes, unless you see something that interests you.

If you've filed taxes with H&R Block previously, you'll be able to import and confirm the correctness of that information. Otherwise, you'll proceed systematically entering your personal and financial information for convenient processing.

Conclusion

Notably, H&R Block's redesign is a significant improvement over their previous version. Easy to read, well laid out, simple and logical progressions, all contribute to make this a great new change to what was once an excellent product but not all that fun to look at or work with. So, hat tip to H&R Block's new design team.

Rob Schultz / IDG

Rob Schultz / IDG TurboTax review

TurboTax is, for sure, the biggest name in do-it-yourself tax filing software. Probably the first software you ever used to file your taxes and likely what you're still using today, for good reason. As I've said in previous years, Intuit has somehow found a way to make you feel more comfortable about doing your taxes.

As with every application we've looked at this year, TurboTax offers the option to consult with a tax professional, but if you file your taxes by March 27, and you qualify for free tax filing, you can have access to a tax professional for free. TurboTax now also offers the option to have a tax expert do your taxes for you. Previously TurboTax only offered the option to have your taxes reviewed by a professional.

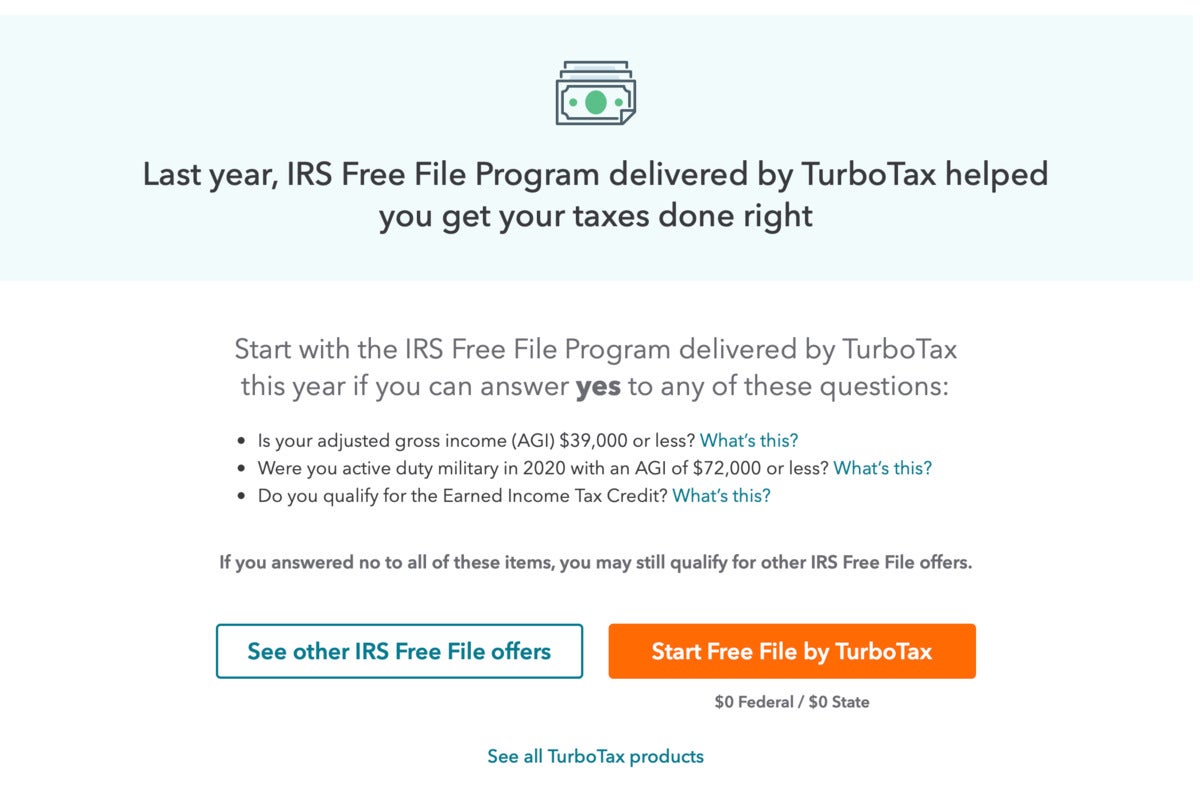

Also notable is that Intuit, who last year got hammered because of how it handled free filing options, this year makes it very clear as to what you can file for free with TurboTax Online and gives you a link to the IRS website to find out who will file your taxes for free if you can't file them with TurboTax Online. And there's an important note to bear in mind with TurboTax: You can only file for free if you have and Adjusted Gross Income of $39,000 or less, or $70,000 or less if you're active duty military. (Unlike the IRS, which lets anyone making $72,000 file for free. So, TurboTax buyer, beware.)

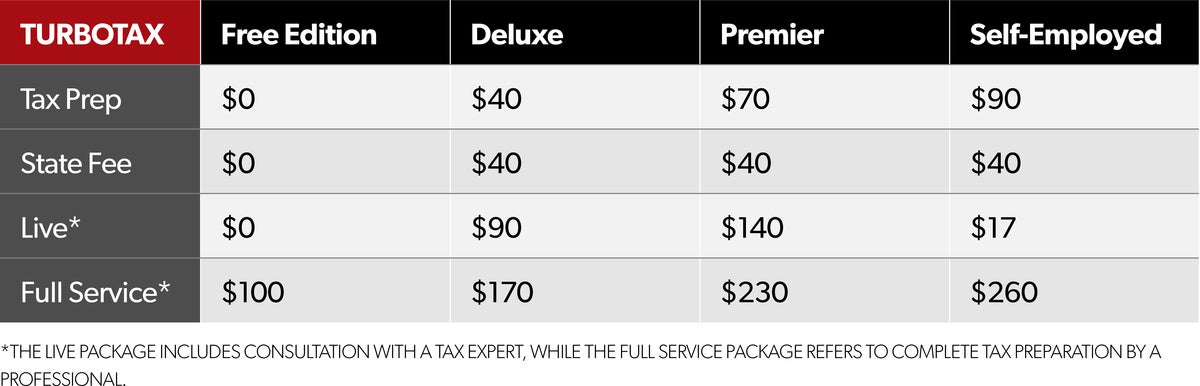

TurboTAx is the most expensive of the three tax services reviewed here, offering four packages that range in price from free to $90. Thankfully, Intuit has dispensed with the .99¢ pricing scheme, rounding prices up to the nearest dollar.

TurboTax

TurboTax TurboTax is being much more up front about its free-file option, after getting busted for skirting that requirement.

The process

Intuit's interview process is the best in the personal tax business and it continues to improve with the latest version of TurboTax online. In addition to the excellent and easy-to-understand interview process, if you answer an interview question that may require special attention, such as payment received as a 1099 contractor, TurboTAx provides more details, and in some cases even detailed videos, to help you understand the tax ramifications and how to properly account for that income and related expenses. Overall, this is a great addition to an already excellent product.

One great benefit of TurboTax online is its ability to directly import data from QuickBooks Self-employed. Intuit has changed the pricing structure a bit from previous years. It used to be that if you bought one you got the other for free. Now you can buy QuickBooks Self-employed as a standalone package, or for a few bucks more a month you can purchase TurboTax with QuickBooks Self-employed, which allows you to use TurboTax to pay your quarterly taxes, based on your work information, directly from within the app. This, alone, is an excellent feature that is well worth the price of admission.

Conclusion

TurboTax remains the gold standard of online tax prep software. While the competition is strong in its own right, loyal Turbo Tax users have no reason to change camps unless they fall within a niche tax scenario that's better served by another product.

Rob Schultz / IDG

Rob Schultz / IDG Which tax prep service is best for….

When it comes to the basics of filing your personal taxes there is very little that differentiates these apps from each other, so, you should opt for the software you're most comfortable with or that you've used in the past. Note that if you've used any of these packages, it's easiest to import your information from last year's tax filing. But, if you're unsure about which app you should choose, or your current tax situation has changed significantly, or you have specific needs, use the following information and our reviews as your guide:

If you made $72,000 or less last year

Have a look at our guide to the IRS' free file options. TurboTax, H&R Block, and TaxAct as well as some competitors have offerings for anyone meeting the IRS standard for free filing.

If you're an active member of the military

All three packages offer options and in some cases discounts if you're in the military, but TurboTax is the most generous when it comes to military members who qualify for free filing. It's the only package that allows military members to file for free with incomes up to the IRS limit of $72,000.

If you own a business that's incorporated

TaxAct remains the best, and perhaps the only, choice for you. Of all the tax software available, TaxAct is the only online service that lets you file your business taxes and then import important information, such as K1s, directly into your personal 1040 filing.

If you're self-employed

TurboTax is still the best choice for you, particularly since it offers a package deal with QuickBooks Self-employed. That package deal helps you make quick work of your self-employment income and expenses and helps you pay your quarterly taxes so that you don't get stung or penalized at the end of the year.

If you want the option to meet with a real human being

H&R Block is the app for you. It's the only option available that will let you take your return to the H&R Block office around the corner and have a living, breathing (and hopefully masked) human being walk you through your tax filing process. But, if you don't actually need to be in the room with your tax person, Intuit's TurboTax now also offers options to have your taxes prepared completely by a tax professional. Of course all three of these services offer some form of live assistance for questions and auditing.

State taxes are (almost) never free

Unless you live in a state that doesn't have income tax or you qualify for one of the free file programs, be prepared to pay somewhere between $30-$40 to file your state taxes. But, if you're filing using one of the free file options you'll find that you can also file your state taxes for free.

Posted by: 18gaugewire.blogspot.com

Source: https://www.pcworld.com/article/3528455/best-tax-software-turbotax-hr-block-taxact-compared.html